The NPV of a project depends on the expected cash flows from the project and the discount rate used to translate those expected cash flows to the present value. When we used a 9% discount rate, the NPV of the embroidery machine project was $2,836. If a higher discount rate is used, the present value of future cash flows falls, and the NPV of the project falls. A financial calculator is able to calculate a series of present values in the background for you, automating much of the process. In summary, NPV profile analysis provides a dynamic view of investment projects, allowing decision-makers to assess risks, uncertainties, and potential rewards.

2 Net Present Value (NPV) Method

It provides valuable insights into the sensitivity of an investment project to changes in the discount rate. Net present value is a financial calculation used to determine the present value of future cash flows. It takes into account the time value of money, which means that a dollar today is worth more than a dollar received in the future. A positive NPV indicates that the projected earnings from an investment exceed the anticipated costs, representing a profitable venture. A lower or negative NPV suggests that the expected costs outweigh the earnings, signaling potential financial losses.

The Cost of Capital

It guides us in selecting appropriate discount rates, understanding risk, and making informed investment choices. Remember that context matters—the NPV profile should align with the project’s specifics and the organization’s risk tolerance. Remember, the NPV profile isn’t just a static graph; it’s a dynamic tool that informs strategic decisions. Whether you’re evaluating a renewable energy project, a real estate development, or a high-tech venture, understanding NPV profiles is essential for making informed choices.

Calculating NVP

- If the required rate of return (discount rate) exceeds this break-even rate, the project generates positive NPV; otherwise, it results in negative NPV.

- NPV is sensitive to changes in the discount rate, which can significantly impact the results.

- Conversely, ROI expresses an investment’s efficiency as a percentage, showing the return relative to the investment cost.

- For instance, at a discount rate of 10%, the NPV might be $12,000, while at a discount rate of 15%, the NPV could be $5,000.

- Net present value is a financial calculation used to determine the present value of future cash flows.

- It takes into account the time value of money, which means that a dollar received in the future is worth less than a dollar received today.

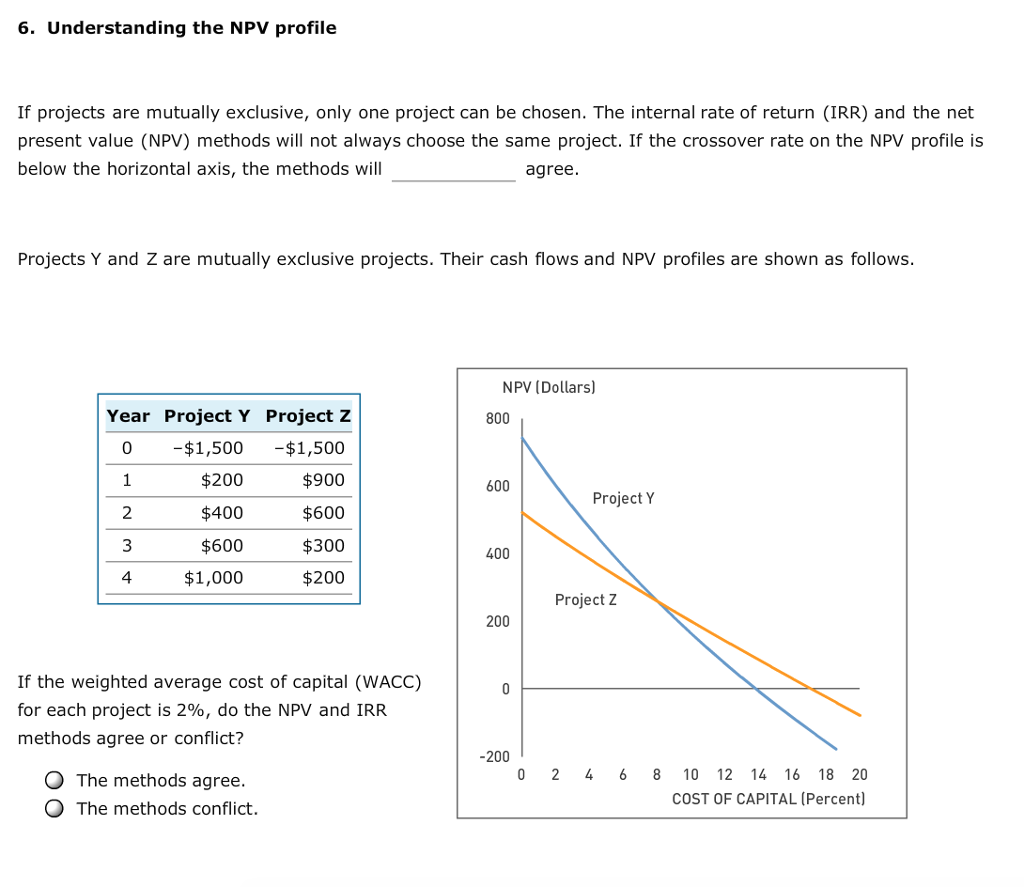

Let’s say you have a project that requires initial investment of $10 million and will generate net cash flows of $3.5 million in each of the next 5 years. If we want to see how sensitive the project’s net present value is to the discount rate, we need to find NPV values for different discount rates say 4%, 8%, 12%, 16% and 20%. NPV provides a comprehensive view of project profitability, considering both timing and risk. By mastering NPV calculations, project managers and investors can make informed decisions and allocate resources wisely. Remember, the devil is in the details—accurate cash flow estimation and appropriate discount rates are critical for reliable NPV assessments.

Net Present Value (NPV) Calculation

Net present value, commonly seen in capital budgeting projects, accounts for the time value of money (TVM). The time value of money is the idea that future money has less value than presently available capital, due to the earnings potential of the present money. A business will use a discounted cash flow (DCF) calculation, which will reflect the potential change in wealth from a particular project. The computation will factor in the time value of money by discounting the projected cash flows back to the present, using a company’s weighted average cost of capital (WACC).

Example: IRR vs NPV in Capital Budgeting

This calculation will provide the present value of each cash flow, adjusted for the time value of money. The cost of that capital depends on whether the company raises the money by borrowing it, issuing stock or some the difference between a capital budget screening decision and preference budget chron com combination of the two. The cost of capital is the discount factor you use to express a future cash flow in today’s dollars. Both NPV and ROI (return on investment) are important, but they serve different purposes.

How about if Option A requires an initial investment of $1 million, while Option B will only cost $10? If, on the other hand, an investor could earn 8% with no risk over the next year, then the offer of $105 in a year would not suffice. The NPV method can be difficult for someone without a finance background to understand. Also, the NPV method can be problematic when available capital resources are limited.

The cash inflow from this project is expected to be $6,000 next year and $8,000 the following year. The cash inflow is expected to increase by $2,000 yearly, resulting in a cash inflow of $18,000 in year 7, the final year of the project. Use a financial calculator to calculate NPV to determine whether this is a good project for your company to undertake (see Table 16.5). The NPV profile intersects the x-axis at the discount rate where the NPV equals zero.